Back-To-Business: A Taxing Situation V: Using PerformerTrack

As I mentioned in the last post in the Back-To-Business series, I've been using Holdon Log's PerformerTrack system for three years now, and it's really made tax time a breeze.

As I mentioned in the last post in the Back-To-Business series, I've been using Holdon Log's PerformerTrack system for three years now, and it's really made tax time a breeze.Now, PerformerTrack is an all-around acting career manager - it tracks a lot more than your income and expenses. When I meet with actors for Private Business Coaching sessions, I often use the structure PerformerTrack instills to help them get their businesses organized. You'll probably notice references to the system popping up more as the Back-To-Business series continues. Today we're going to focus on the Income and Expenses section.

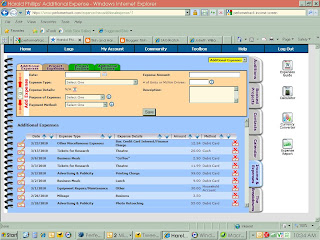

As the video above shows, the Income and Expenses section of the system tracks every deductible expense listed on Actors Tax Prep's expense sheet - and it categorizes your expenses by project, to allow for better reporting at the end of the year (remember, W-2 expenses are deducted as "non-reimbursed job-related expenses" - so having expenses broken out by project really helps when filling out those 1040's.)

Using this section of the system is pretty basic - we've already talked about how you should be saving your receipts, and noting the purpose of your expense on those receipts (remember, you have to justify those expenses!) Before you take your receipt and drop it into your handy accordion file, though, take a second to log into Performertrack at http://www.performertrack.com/, and click the "Income/ Expenses" tab.

You'll note that four tabs appear on the top of the "Expenses" screen. If the receipt you're entering into PerformerTrack is related to a specific project (like, for instance, parking at an audition or dry cleaning a costume for a show), then you'll want to click the "Project Expenses" tab and choose the appropriate project from the yellow menu at the upper-right of the screen (that drop-down menu says "Additional Expenses" now, because that's the screen we're in!).

Fill out all the fields in the expense screen (whether "Project Expense" or "Additional Expense - the fields are the same). It's important to note that the "Expense Details" section changes, depending on the type of expense you're logging. So, for instance, if you're logging expenses for your Home Office - again, be sure you check with a tax professional about whether or not you qualify for the home office deduction - the "Expense Details" drop-down changes to list specific types of expenses associated with your home office (homeowners insurance, rent, alarm fees, etc.) The small red, white and blue icon next to that drop-down links you to PerformerTrack's online expense guide - a handy source of information on deductible expenses actors can track in the system.

See the little "blue cross" icons next to the "Purpose of Expense" and "Payment Method" drop-downs? Those icons indicate that you can create your own items on that list. This allows you to break down your expenses even further - you can track how much money you spent parking for auditions vs performances, for instance... or how much you spent on your credit card vs. your bank account.

Finally, be sure to note all the details about your expense in the "Description" box. This is a more expansive version of writing on your receipt - you can note the purpose of your expense, who you met with, what you discussed, or anything else that you think would help justify the expense should the IRS... uh... "ask" about it :).

Click "Save," and your expense is logged into the system. Seem like a lot of work? It's really not, once you get into the habit of entering your expenses ... and the payoff every April is well worth the time you spend. What pay-off am I talking about? Well, look at the far-right of the screen... do you see that white button labeled "Expense Report?" A little work every day/ week/ month entering your expenses into the system will pay off when tax time rolls around and all you have to do is click that button - producing a report of all your expenses for the year.

The income section works in much the same way - you enter the income you've made for each project into its own screen (you'll notice that there's also a section for "additional income"... I've never used this section, as all my income is related to some project I've worked on - but it's there).

The income section works in much the same way - you enter the income you've made for each project into its own screen (you'll notice that there's also a section for "additional income"... I've never used this section, as all my income is related to some project I've worked on - but it's there).There's a couple of things to note about PerformerTrack's income screen - See the spaces for "Gross Amount" and "Net Amount?" Recording these figures help you double-check to see how much withholding you've already paid on your W-2 income - and many agents base the commission you owe on your GROSS pay for a job, rather than the NET.

A large portion of union dues are based on a percentage of the union earnings an actor brings in every year. That's why PerformerTrack added the Union Affiliation drop-down. Many union performers have to scramble every year - again, the same way they do at tax time - to pull together pay stubs and memos, so they can figure out how much they owe their union in dues. When you enter your income into PerformerTrack, you can specify whether the income was SAG, AFTRA, Equity, etc... or whether it was non-union. If you've tracked this information in the Income screen, dues-time becomes a snap - all union performers have to do is run an income report, and their union earnings are displayed on one page. This saves a lot of time and effort!

Finally, take a look the PT and CT icons on the right side of the income screen. Remember my recommendation that you set up a bank account for your acting business? One of the many advantages to keeping a business account is the ability to hold a percentage of your income back to pay for your acting expenses. Like headshots - you know you need them. Saving a portion of your acting income in your business account will help you pay for them in a matter of months!

PerformerTrack calls this your "Performer Trust" account. This area of the expense screen prompts you to hold back a certain percentage of your acting income for these business expenses. Just choose "Yes" in this area, and the system will calculate an amount to hold back - from 2.5% to 20% of your pay check. You don't have to hold money back in your "Performer Trust" account... but if you ever want to get ahead and pay for some of those expenses, the cash has to come from somewhere! You'll note that there's a Performer Trust Report button on the right side of the screen... you can pull up a report at any time to see how much you've saved towards that new reel or pair of shoes.

The second icon, "CT" is a Child Trust tracker. Parents managing their children's performing careers are familiar with the Coogan Law - I'm not as familiar with it because, well... I don't have kids who are actors. My understanding, though, is that parents are required to withhold 15% of all their child actors earnings in a trust account. This area in the PerformerTrack income screen lets you track the amount deposited into that trust account. I'm obviously weak in this area... for more information take a look at this section of the official PerformerTrack site.

Again, all the details PerformerTrack's income system asks you to record may seem a little daunting... but when Tax-time comes around, being able to print a report detailing all your income can't be beat! No more sorting through W-2's and 1099's, adding up gross vs. net figures... once it's in the system, you can just run a report and transcribe it onto the appropriate tax form - or drop it off with your tax preparer. He/she'll be very grateful to you for making the job so much easier!

I'm sure that after all this, you can see the advantage of tracking your income and expenses in PerformerTrack - and now is the time to start! We're not too far into the year, so adding the income you've made and the expenses you've put out this year wouldn't be as long a process as it would be in, say, September! As I mentioned in the last post, HoldonLog has offered my readers a special discount: if you want to check the system out for yourself (and I'd highly recommend that you do), you can save 20% off a one-year subscription by entering the coupon code PORTLAND9 in the check-out screen. Now's the time to get started... before those receipts and pay stubs start to pile up again!

Next week we're going to take a step back from just tracking your income and expenses for taxes... we're going to talk about using your money to help build your business, rather than letting the money control your decisions. Until then...

Let's get to work!

-Harold

Labels: actor, Actor's Equity, Actors, AFTRA, Dues, Expenses, Income, PerformerTrack, SAG, Tax preparation, Tax Prepartion, Taxes, Tracking, Union

.gif)