The Back-To-Business Series: Index Hi there folks... did you think I'd forgotten you? Sorry about the late post today; I had to suspend this morning's answering of your questions to run to Oregon Public Broadcasting for a voice session. I'm back now, though... lets dig into the inbox and see what some people had to say about Monday's post on Tracking Tools.

Hi there folks... did you think I'd forgotten you? Sorry about the late post today; I had to suspend this morning's answering of your questions to run to Oregon Public Broadcasting for a voice session. I'm back now, though... lets dig into the inbox and see what some people had to say about Monday's post on Tracking Tools.

... but I'm confused about mileage tracking. I thought that actors couldn't dedcut mileage for going to rehearsals and shows. JD (Athens, GA)

Ok - say it with me - I'm not a licensed tax preparer, so don't take my word for this. If you've got questions about what you can deduct and what you can't, please please please spend a couple of bucks to see a tax professional and get those questions answered. If the IRS calls your deductions into question, you want an expert by your side to defend the deductions you've taken... and I can't do that for you!

With that being said, here's my understanding of the situation: The IRS doesn't allow people to take "commuting miles" as deductible; that is, you can't write off the miles you drive from your home to your job. You can, however, write-off mileage from one job site to another. So, for example, you can't write-off the mileage you drive from home to the coffee shop you work at. If you go from that coffee shop to the bank so you can deposit the night's take, however, you can deduct that mileage (you just can't deduct the mileage from the bank back home.)

Now, as actors our job sites are casting offices, theaters, film sets, and the like. We have to follow the same rules as everyone else - we can't deduct the mileage we drive from home to those job sites. As sole proprietors of our own businesses (remember, that's what filing a Schedule C makes you), though, We can deduct the mileage we drive from our offices (one job site) to these other sites. The key to justifying this mileage is to be sure that you've got a qualified home office set up.

Now, again, I'm not a licensed tax professional - you should definitely consult with a licensed expert to be sure your home office qualifies for the home office deduction. If it does, then all mileage from your home office to your job sites is deductible - when you're doing a Schedule C job. When you're doing a W-2 job, you've been hired as an employee by the production company, so all mileage from home to the job site is considered "commuting miles," and is therefore not deductible.

One more time... consult a licensed tax professional if you've got questions about the specifics of the mileage you drove this past year...

... I don't get how my calendar is going to help me "justify" my expenses. It's just got my appointments in it, doesn't it? BR (St. Louis, MO)

... What do you mean about meetings? I'm not Sandra Bullock, "taking meetings" with big-time producers to pitch my latest movie. I'm just another Portland actor out looking for work. AF (Portland, OR)

These two questions actually relate to each other. A lot of the "business" of show business doesn't take place on stage or in front of the camera. It doesn't take place in the rehearsal room, or at your agent's office. A lot of the "business" of show business takes place at parties, bars, coffee shops, and restaurants.

It's been said that show business is a "personality" business - that how you come across to producers/ directors/ casting agents in informal situations (such as Portland's weekly Leverage viewing parties, or at film premieres) goes a long way toward your getting work on that next project - or on a project a year down the line. While people outside "the business" look at film screenings and industry parties as glamorous events where pretty people rub shoulders, those in "the business" look at them for what they are - business events. Opportunities to get to know the people who have the power or influence to get you hired on that next job. Opportunities to be seen, and to promote yourself. Like any other activity geared towards building your business, what you spend on these events is a legitimate deduction.

See, you never know who's going to help you get that next job. It could be that director you met at that party that actor threw... or it could be the young actress you go out to coffee with after rehearsal. Or, it could be the grip you introduced to a the aforementioned director over lunch - he hears about an opening on another project, and he could very easily put in a good word for you. Just about all our activities with industry contacts can lead to future work... which makes all of our lunch/ coffee/ bar dates business meetings - if you talk business with those contacts.

Which brings us back to our calendar... noting every meeting you have with industry contacts helps you to justify the miles you drive to get there, the meal and/ or drinks you buy (only half of that amount is deductible, though...), your parking, etc... an actor friend calls you up on the spur of the moment and says, "Hey, lets grab lunch?" Go - but be sure to note the meeting in your calendar! Not only will it help you justify the expense - it'll remind you about the meeting when you're hunting for deductions at tax time!

And, finally, here's one I get asked a lot!

You're always out there pimpin PerformerTrack - do you work for them or something? SD (Antioch, TN)No, I don't work for

HoldonLog, the company that makes

PerformerTrack. I'm just a

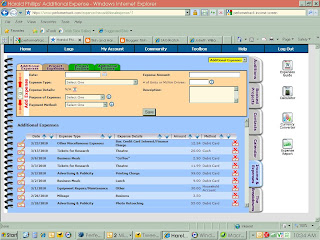

very satisfied user of the web-based system - it's been an invaluable tool for me over the past three years. Since I started using

PerformerTrack (and its predecessor

ActorTrack), I've started thinking of my acting career as a

business - in fact, a lot of the information I share with actors in my

Personal Business Coaching sessions and here on the blog are derived from the lessons I've learned by using those systems.

We'll talk more about

PerformerTrack in next Monday's post... and don't be surprised if you hear more about it in coming weeks as well. It really is a great way to take charge of your career!

Until then...

Let's get to work!

-Harold

.gif)