(If you're here looking for a list of deductible acting expenses, then

click here to jump to the Expenses section of this post.)

So, here it is. The first day of March, and

April 15th is right around the corner. If you're like a lot of actors out there, you're dreading the approach of tax day - you know you need to get your paperwork together and your taxes filed, but you can't quite make yourself sit down and do the work. You know that you should be able to find deductions that will increase your refund (or at the very least, reduce the amount you owe), but you're unsure of what you're allowed to write-off... and if you do know, you're not sure how much you spent last year. I know, I know... it's paralyzing!

Stop. Take a breath. Tax time doesn't have to be so... taxing. Today we're going to talk about some tax-time basics - the stuff you have to know to get your taxes filed this year. Along the way, we'll be talking about some core concepts - the why behind the what. Then, next week, I'll pass on some tips to help structure the way you do business in the coming year - to make next year's taxes easier, and the process less of a burden.

Before we go much further, I want to make something abundantly clear - I'm

not a tax professional. If you have

ANY questions about the specifics of your tax situation, don't take my word for things - consult a licensed tax professional. I'm just going to speak in general terms about things I've learned over the years as a professional actor. Oh, sure, you can still

email me or pass your questions to me

on Twitter - as always - but "Harold said so" isn't going to do you much good if you're ever audited. Learn the names and numbers of

tax professionals in your area who understand the special needs of performers, and invest the money to get solid advice when you need it... it's worth it, and hey - it's a deductible expense!

Now, I said at the close of

last week's post that the IRS determines a lot about how we do business... and it's true. Whether you like the concept of taxation or not, any time money exchanges hands in the United States our friends at the

Internal Revenue Service want to be involved. There are ways to minimize the amount of money that you pay the government, but it will always expect its cut. As Mr. Franklin said, "In this world nothing can said to be certain except death and..." Now, any time money changes hands for a service, there's a business relationship... and the IRS governs those relationships as much as (or perhaps more than) any other body.

So, lets talk about that exchange of money for services... Without going into the

vagaries of the tax code (and again, I'm not a tax professional) there are two types of income that actors bring in through their work. These income types are usually referred to - as a kind of short-hand - by the forms you fill out when you start working on a project. Many of you are probably most familiar with

W-2 income or "Wages" - that's the type of income you most likely bring home from your "survival job - " the restaurant or office you work at gives you a check on pay-day, and they

withhold from that check the taxes, social security and medicare contributions you owe the government. When you file your taxes, you balance the amount

withheld from the check against the amount of money you made... and that formula determines whether you owe the IRS a check in April or whether they send you a refund.

The other type of income that actors generally bring in is

1099 income or self-employment income. This is also referred to as

Schedule C income (after the tax form you file to report it) and, sometimes, as

Contract Income. There's a good reason for that last term: Self-employed people generally sign a contract at the outset of a project (at least they

should...

); that contract stipulates how much the "contractor" will be paid for his or her services. Money is not

withheld from the fee paid on a contract, so the contractor is responsible for for paying the taxes, social security and medicare contributions owed to the government on that amount.

(There are other forms of income that the IRS taxes, including Farm and Interest income, capital gains, etc... again, consult a licensed tax preparer for more information on these. I'm mostly talking about the type of money an actor is going to be paid for his/her work over the course of a tax year.)

A little story about the difference between W-2 and 1099 income... when I was 18, I went to work for the University of Alaska, Anchorage in their summer stock program. I was paid what I considered a princely sum at that time... something along the lines of $1100.00. At the end of the summer stock season I did what most 18 year-olds would do - I pocketed the money, ate lots of pizza, drank my fair share of beer, and went about my collegiate life. When it came time to file my taxes the following year, I was stunned to find out that - for the first time in my life - I owed the government a check for my taxes.

Up until that point I'd just worked in restaurants or TV stations, filed my form 1040, and gotten a refund. The difference was the 1099 income I'd received from the University - nothing had been withheld from the check I got from UAA, so there was money due. That was a very lean month around my college household, as I scrambled to pull together the needed funds... remember, the Government always wants its cut!

So, as mentioned above,

1099 income is "self-employment" income, and it's reported to the IRS on a

Schedule C, which is attached to your standard tax form -

Form 1040... where your

W-2 or

Wage Income is reported. Got that? (That's

ok... feel free to read it again. I can't imagine how

anyone could be confused - I mean really! :) )

Actors do receive

W-2 income - especially if they're members of

SAG,

AFTRA, or

Equity - union contracts are generally administered through payroll companies, which take care of withholding. A lot of our work, though, is payed for on a

1099 basis - especially here in smaller markets where there's more non-union work than union. As I said before, the IRS

always wants its cut - and they'd prefer it if we give them the tax on our expected earning quarterly - in the form of

estimated taxes. This is the 1099 version of

withholding. You can choose not to pay quarterly estimates, and instead pay the total tax owed in April... but there will be a penalty assessed - and depending on how much 1099 income you made that year, it can be

STEEP!So, we pony up every quarter - or we pony up in April - to pay the tax on our 1099 income... but there is a little salve for that pain. The IRS considers Independent Contractors (anyone filing a Schedule C for their 1099 income)

businesses, just like

Coca Cola or

General Motors. Those companies have to pay for things in order to make and sell their products - and so do we. Coke and GM get to deduct those expenses from their annual taxes, thereby lowering their tax debt... and so do we! You see, the government taxes a businesses

profit - the amount of income that business has made

minus the expenses its paid. So, if we want to be taxed on just the profit we've made from our 1099 income (and not the sum total of all we've been paid), it's up to us to tabulate our business expenses.

We can do the same thing if the majority of our income is W-2 income... but that falls into the "itemized deduction" category of your 1040 form. There are some restrictions on the deductions that you can take on W-2 income - consult a tax professional about these.

Consider - because we run a business (I'll call it "Actor Inc." - though that's not to say you should incorporate... there's a topic for another article...) we have to advertise to prospective clients.. just like Coke and GM. We get photos taken and printed. We have reels cut together by editors. We keep web sites to advertise our services. We have to get ourselves to auditions, rehearsals, shoots, and screenings - and we have to park at all those places. We pay to train in our craft... we pay commissions to our agents and managers - and some times we have to pay lawyers, bookkeepers and doctors. We have to pay dues, subscribe to trade papers, buy scripts... the list goes on and on (In fact, the list is right

here, courtesy of LA's

Actor's Tax Prep. Print it off and keep it with you... it'll help you file this year's taxes, and help you in the year to come!)

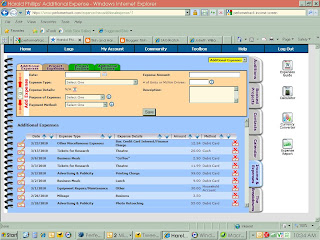

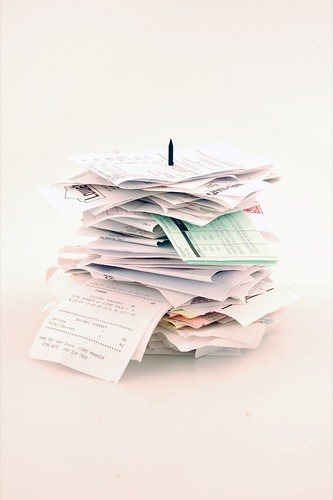

Be careful with what you claim, though... We have to have tangible evidence that we've spent money on our business in order to write those costs off - which is why you've (hopefully) saved the receipt for everything you've bought or paid for to help run your acting business. If you don't have a receipt, and the IRS audits you, deductions for those costs will be disallowed... and you'll probably have to pay a penalty for claiming them in the first place.

Something else to watch out for: the IRS

only extends this benefit to

real businesses. As I said before, W-2 employees can write off most of the expenses they incur in pursuit of their jobs as well... but either way the "cost of doing business" is only deductible for a

business. This seems like a simple concept... but actors who can't prove to the IRS that they're running a for-profit business tend to get in trouble - if you can't show the IRS that you do the work required to manage a business, they'll consider your acting career a "hobby" - and a model train collector doesn't get to write off the cost of his or her tracks. Unless you're actively running and managing the business of "Actor Inc.," they'll disallow all those write-offs you want to take against your income.

Which is why it's so important to track your expenses as you go about the daily work being a professional actor requires. If you've done that, then tax season should be pretty easy for you - you've probably got all of your receipts in one place, separated by job, by date and

type of expense.

You've probably tracked your mileage or transportation costs for the entire year, and noted the purpose for each trip (and, if you want to be extra careful, the odometer reading of your car at the beginning and ending of the trip - in case the IRS wants proof of the mileage driven). It should be noted that there are some restrictions on this for W-2 income - be sure to consult a tax professional about this.

You've noted all the income you made in the past year (both W-2 and 1099) - whether paperwork was sent to you or not - and you've separated that income so you can note it on the appropriate form (1040 or Schedule C.)

You've got notes detailing the square footage of your home office (the area in your home set aside for no other purpose than to run your business). You've also noted your rent or house payment and utilities - so you can claim those items as part of your home office. Again, there are restrictions in this area - be sure to consult a tax professional before claiming a home office, to be sure you meet all the requirements.

You've got notes about when you bought equipment for your home office (or, for that matter, any equipment you use solely in your business) for

depreciation .

You've got notes on any out-of-town trips you've taken, and you've kept the receipts for those trips separate from the other receipts for fuel, transportation costs, meals and lodging (

per diem is a separate, deductible expense).

You can prove the business purpose of that dinner you had with a director, and you've noted his/her name on the receipt and what you met about.

If you've got all that covered... then you're ready to go! Start running your favorite tax program, or bring your materials down to a tax preparer and have him/ her start filing. If you don't... well, you've still got 45 days.

Next week we'll talk about how we can make

next year's tax season a lot smoother... by setting yourself up to track your expenses and income as you go, instead of all at once at the beginning of the year. As always, feel free to

email your questions (or send them via

Twitter) - but remember, I can only speak to generalizations. I'm

not a licensed tax preparer.

Lets go to work!

-Harold

.gif)